Child Tax Credit 2024 Canada Form – Additionally, the refundable portion, known as the additional child tax credit, allows up to $1,600 per qualifying child. To be eligible for the child tax credit, you must be a parent or guardian . People filing in 2024 are filing such as the child’s age, relationship with the claimant and income conditions. The credit can be claimed on the federal tax return (Form 1040 or 1040-SR .

Child Tax Credit 2024 Canada Form

Source : www.pandadoc.com

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

How to fill out TD1 form if you have two jobs

Source : www.lucas.cpa

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

How to fill out TD1 form…. There is a similar form to fill out for

Source : www.tiktok.com

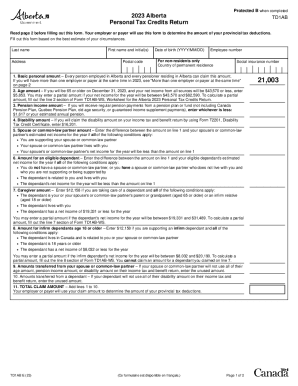

Canada TD1AB E Alberta 2023 2024 Fill and Sign Printable

Source : www.uslegalforms.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

$2000 State Child Tax Credit 2024 Payment Date & Eligibility News

Source : cwccareers.in

25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com

$2000 State Child Tax Credit 2024 Payment Date & Eligibility News

Source : cwccareers.in

Child Tax Credit 2024 Canada Form Free Digital TD1 2024 Form (Personal Tax Credits Return): including the age of the child, their relationship with the claimant, and their income, to qualify. To be eligible for the credit, the taxpayer must submit a federal tax return (Form 1040 or 1040-SR) . Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)